1. You spend a lot of time finding and buying the goods and services you need to run your business.

Every time you need to purchase supplies you start a fresh search on Google or Amazon. You spend a lot of time comparing products, reviews, prices and suppliers. Once you find what you want, you send an email to your boss or finance department asking for approval. Finance then spends more time validating that you found a good price, and checking your request against budget and spend projections. Eventually, you get what you need. The process repeats every time someone needs to purchase goods or services.

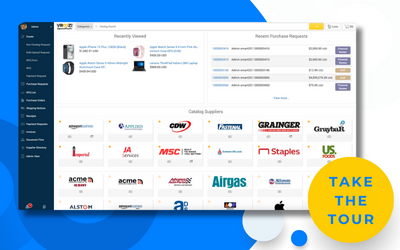

If this sounds familiar, automating the purchase process – and having an easily-accessible digital marketplace with approved vendors, products and pricing that employees can buy from – will make life significantly easier and more efficient for everyone. Employees get the products and services they need faster and finance and procurement teams maintain control.

2. You are manually managing, confirming and double-checking vendor invoices.

Was the invoice the amount you expected? Did you actually receive what you purchased? Is there a chance the invoice was already paid by someone else?

If you have ever asked these questions before, procure-to-pay automation will drastically improve accounts payable efficiency and control, while cutting down on costly errors, like overpayments. There’s also a hard cost savings: Paper invoices can cost up to $15 per invoice to manage. Electronic invoices typically cost less than $1.50.

Automated vendor invoice capture and management reduces costs, save times, improves operational efficiency, strengthens spend controls and increases cycle times.

3. You are still cutting and mailing paper checks.

We’ve completely transformed the way we pay in our personal lives. From PayPay and Venmo to automatic bill pay and digital banking transfers, it’s very rare that we cut and mail checks at home. Why are we still paying this way at work?

Like invoice management, the estimated cost for a manual payment is very high (upward of $8.00 per check). On the other hand, the fully loaded cost of a digital payment is between $1 – $1.25. Every dollar adds up, especially for organizations with large invoice and payment volumes.

4. Your employees surprise you with expenses and purchases.

Have you ever been surprised at the cost or timing of an employee purchase or expense reimbursement request?

If so, you’re not alone. When there are no clear processes for managing business purchasing and employee expenses, or the process itself is too cumbersome and difficult, employees will make do with what they have, resulting in an increase in rogue spending. You can’t blame your employees – they need to be productive and get the goods and services necessary to operate. But that won’t stop the sudden impact on your budget and cash flow.

5. Financial and AP productivity dips while working remotely.

If productivity and efficiency has slipped as a result of the new work from home normal, it’s time to digitize.

Effective remote work requires that you equip employees with applications that follow them where they work – whether that be at the office, on the road or at home. In the wake of the pandemic, some companies no longer have anyone at the physical office to check mail for payments and bills, process paper invoices, or make check runs – which crystalizes the importance of modernizing procurement and AP processes.

While the paper-based aspect of these procurement and AP functions are tactical, the financial implications are not. Processes like business purchasing, accounts payable, expense management and vendor invoicing directly impact cash flow and the bottom-line. Any delays in these areas affects spend visibility, budgeting, and often, the balance sheet.

If one or more of these signs resonate with you, it’s time to consider procure-to-pay automation. The time and financial savings produced by P2P automation pays for itself in a matter of months.

To learn more, check out our latest report: Procurement and AP Processes Ripe for Automation.

Or, get the 10 questions you need to ask when choosing a procure-to-pay solution.