The majority of people pay their bills online. So why are organizations still relying on paper checks to complete business payments?

Manual and paper-based business payment are always inefficient and costly. But they are especially painful today. With most organizations still operating remotely or in a hybrid environment, who has time to make a trip to the office to check the mail, write or send paper checks?

It’s time to modernize and digitize.

Automating and digitizing business payments eliminates the burden associated with manual accounts payable processes and increases efficiency, savings and financial control. If you haven’t considered modernizing your business payments process yet – here are four reasons why you should rethink your approach today:

1. Cut payment costs.

Bank of America estimates that a paper check can cost anywhere from $4 to $20, depending on the price of the check, how many checks you’re processing and shipping costs.

And that cost doesn’t even account for the time your finance team spends writing, mailing, and reconciling payments. It also doesn’t factor in the resources your team spends manually collaborating and communicating with suppliers.

On the flip side, moving to digital payments can save organizations a whopping 65-75% on payment costs.

2. Increase financial control.

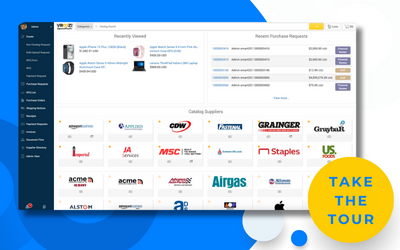

Automated payment processes that integrate directly with existing financial systems make it easier to keep track of who you’re paying, how much and when. This visibility is key to optimizing cash management, strengthening budget control and reducing fraud.

Digital payments also increase financial control by eliminating costly mistakes, like issues associated with overpayments, duplicate invoices or payment errors. As part of an integrated accounts payable strategy, three-way invoice matching, digital workflows, and automated approval processes ensure you only pay for what you buy and receive by verifying payments against purchase orders and invoices.

Automation also makes your life easier. With the right tool, approving a payment or a batch of payments is as easy as clicking a button. Automation eliminates the tedious process of manually entering in each payment request, double checking for accuracy, sending to the appropriate approver and waiting for the invoice to be paid.

3. Improve supplier relationships.

Don’t pass your payment headaches onto your vendors. Instead, pay your suppliers the way they want to be paid – digitally. They’ll thank you when they automatically see payments hit their account. Your AP department will also thank you when they no longer have to spend hours tracking down payment statuses and updating vendors. In addition, when you strengthen and simplify supplier relationships, your vendors will put more time and effort into your business. When they save, you save.

4. Reduce fraud and risk.

While fraud can never be completely eliminated, manual payment processes increase exposure. Digitization can help identify instances of fraud or non-compliance automatically.

For example, by digitizing your invoice-to-pay process, you can ensure that purchases and payments only go to pre-approved suppliers that are included in your vendor master file. In addition, digital solutions automatically verify invoices with three-way match, predefined rules and custom validations – helping you catch and eliminate fraud before it impacts your bank account.

Accounts Payable Automation: Digitize Today

If your organization is struggling with the inefficiencies and costs of manual and paper-based processes, it’s time to rethink your strategy. Digitizing and automating financial processes – including purchasing, invoice capture, management and processing, and payments – adds immediate value, and is necessary to scale your business over time.

While full procure-to-pay digitization delivers the most ROI, many mid-market businesses start their digitization journey with vendor invoices and business payments. This strategy allows finance and AP teams to digitize incrementally, add value now, and expand over time.

Interested in learning more about what a digital procure-to-pay solution can do for your organization? Schedule a demo.