A recent Deloitte survey of CFOs highlighted the importance of cost control and cost optimization to drive growth in uncertain times: Deloitte’s CFO net optimism index declined in Q3 2019, registering its first negative reading in nearly seven years. At the same time CFOs’ key goals include controlling cost. Cost control isn’t limited to achieving savings, and some would say it’s better used to help re-allocate budgets to accelerate growth and competitiveness. Implementing spend management technology is a key step to achieving spend cost control.

Finance leaders hate uncertainty – particularly when it comes to indirect costs, rogue spending and most importantly, profits. For many companies, the purchase, invoice and pay process is often not fully optimized for cost control. This is especially true for small and mid-sized organizations who have traditionally lacked access to enterprise-grade software, designed to digitize these processes. But today, automating the procure-to-pay (P2P) process is a fast and easy way to give CFOs and controllers more control, certainty and visibility.

At the simplest level, P2P automation reduces manual purchasing processes, decreases costs of goods and services, and enables organizations to work faster, smarter and more efficiently.

Here are three ways that automation and digitization improve financial performance and certainty for the mid-market.

Improved spend controls and visibility

Every company goes through different financial maturity lifecycles. The early stages are filled with challenges and complexities – mostly resulting from paper-based and manual AP and purchasing processes. One of the biggest challenges facing SMBs and Mid-Market: a lack of visibility into what’s being spent, by who, and with what suppliers. P2P automation enables financial leaders to improve spend controls and increase visibility into where money is being spent – without the need to build a robust procurement function. Spend controls help companies on both the micro and macro level. On a micro level, employees are guided to make better day-to-day purchasing decisions. On a larger scale, spend controls increase spend management and transparency, which provides critical insight into both current and historical spend. This data equips CFOs to make smarter decisions about investments, budgets, suppliers and more.

Vendor Management, Savings and Centralization

Digital purchasing equips companies with more negotiating power, visibility and control. On the other hand, organizations that rely on paper-based processes end up spending more than necessary, often with vendors that aren’t priced competitively. Eventually, the company ends up with a large, unmanageable set of vendors, making it hard for employees to make smart and timely purchasing decisions. Naturally, for CFOs, this makes tracking overall spend even more difficult.

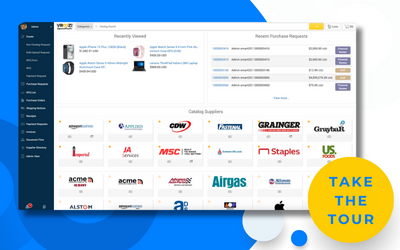

Once the P2P process has been digitized, everything can be managed in a central platform. Employees can easily search and purchase from a marketplace of pre-approved vendors and suppliers. This ensures finance knows which vendors the business is using, and that their employees take advantage of pre-negotiated discounts. Requisitions, purchases, invoices and payments are all tracked centrally and electronically, eliminating errors and overpayments – and saving a lot of time and money.

Spend Management, Efficiency and Accuracy

Manual purchasing comes with a hefty set of challenges. Chief among the concerns: inefficiency, trackability, accuracy, budget constraints, and the high cost of managing paper-based processes such as purchase requests, purchase orders, vendor invoice processing and payment via checks.

Given the finite resources available in the typical finance and AP department, few companies have the time or people to manage paper, update spreadsheets, validate data and fix inaccurate data. This becomes especially challenging at month-end, quarter-end and year-end.

Think about it: How would you rather spend your time? Manually approving PO’s and invoices, validating contracts and fixing spreadsheets, or making big decisions that improve financial performance? How would you rather spend your budgets? On resources typing paper invoices from suppliers and performing check runs, or growing the business with resources that perform more strategic tasks such as innovation, sales and marketing.

Automation enables you to focus on what matters most by making your job faster and easier. By automating key processes – like requisitions, purchase approvals, invoicing and payments, among others – and the accompanying data management – you can dedicate staff resources to more strategic items, like uncovering new savings opportunities, improving cash flow and more strategically managing profit and loss. Ready to increase spend certainty and financial performance? Check out Vroozi’s Q&A with Spend Matters around how companies can automate purchasing, AP and spend management to scale their business and manage growth.