Increasing supply shortages, ongoing business disruptions, rising inflation costs, and an unpredictable workforce are causing organizations to question existing operational efficiencies, especially when it comes to maintaining financial resilience and cost control.

More purchasing, accounts payable, and finance departments in fintech enterprises are turning to digital automation, recognizing that manual and paper-based processes can waste time, reduce productivity, and hinder employee performance.

But even among high-performing teams, there’s still progress to be made.

The Disconnect Between Fintech and SpendTech™

SpendTech™, or spend management technology, enables companies to manage and oversee the spend visibility that goes toward goods and services needed to operate. Alternatively, financial technology (fintech) focuses on automating and enhancing financial controls for early payments, effective cash management, and supplier health.

The disconnect between the two technologies is caused by silos between finance and procurement departments, with each operating under its own processes, priorities, and systems.

When SpendTech and fintech intersect, there’s ample opportunity to boost operational efficiency. If procurement and finance teams work together and leverage the latest SpendTech and fintech technologies, companies can bring greater speed, higher visibility, and more control to their business purchasing process. This merging of technology also allows them to electronically automate payments between buyers and suppliers.

With both spend management technology and financial technology, companies can orchestrate each buyer and supplier connection with zero friction. Are your procurement, accounts payable, and payment operations seamless and effective? If not, here are four reasons you should rethink your SpendTech and fintech strategy:

1. Gain Greater Financial Control

Relying on manual purchasing and AP processes takes valuable time and resources away from more strategic financial initiatives. It also limits an organization’s control over spend visibility.

Simplifying business purchasing and spend management with technology can help you take advantage of pre-negotiated rates, especially when operating within the confines of the broader procurement and spend management strategy. An automated business buying process benefits both the organization and its teams. Employees get what they need to run the business, and the business maintains strict cost control.

But don’t stop there. Managing purchase orders, vendor invoices, and payments manually can expose an organization to an increased risk of overpayments, duplicate invoices, and payment errors. Most modern procurement and accounts payable systems include functionalities such as automated invoicing, purchase orders, and budget checks that eliminate these issues, improve cash flow, and increase financial control.

2. Increase Spend Visibility

SpendTech and fintech create a wealth of new data that organizations can analyze to boost financial outcomes. With everything digitized—budgets, purchase orders, invoices, receipts, payments, and more—organizations gain visibility into how much they are spending and from whom they are purchasing.

With more visibility, you can identify opportunities to save money, reallocate resources, invest, and increase control.

Automating the company’s purchasing processes also enables you to make confident spend decisions based on hard data versus guesswork. Managing the procure-to-pay process manually can negatively impact data quality because it’s more likely to be outdated, incomplete, or error-prone.

By automating the gathering, cleansing, and normalizing of spend data, you can create a single source of truth that can be relied upon to make decisions and analyze business performance in real time.

3. Turn Procurement and Finance into a Profit Center

When spend management and financial tech are used together, procurement and AP cycle times drastically decrease. Don’t let the use of manual payment methods hold you back. Complete SpendTech and fintech convergence includes electronic payments, resulting in cost- and resource-related savings.

With faster cycle times, your company will have more flexibility in how it manages its cash, such as early payment discounts, rebates, and investment opportunities. Early payments could also strengthen relationships with suppliers and improve financial health. This gives your company better choices for how it manages working capital.

With SpendTech (upstream decision) and fintech (downstream invoice and payment processing) working cohesively, you can identify the cash management opportunities of any buying decision and reach a better financial outcome.

4. Intelligently Automate

Financial technology creates new efficiencies and reduces or eliminates time-consuming, manual work, putting organizations in a better position to scale without increasing risk or staff.

Digital and artificial intelligence (AI) are the one-two punch that enables companies to validate data, match to approved spend, accurately apply the accounting, and “chase people” for any approvals. This financial tech not only boosts work efficiency, but also eliminates unnecessary work hours. Automation delivers accurate data in real time so people can turn their attention to more strategic activities.

Why do we think “best in class” is the best we can do? Why do we settle for “best-in-class” exception rates and straight-through processing (STP) rates? With intelligent automation, better outcomes are possible across the procure-to-pay process.

The Future of AP and Procurement Is Here

With increasing pressure to reduce costs, boost efficiency, increase resilience, and drive positive financial outcomes, procurement and finance teams that haven’t implemented and connected fintech and SpendTech are at a severe disadvantage.

Financial technology and automation have the power to improve processes and eliminate errors. They can also be leveraged to create real financial opportunities, establishing procurement and finance departments as true strategic partners.

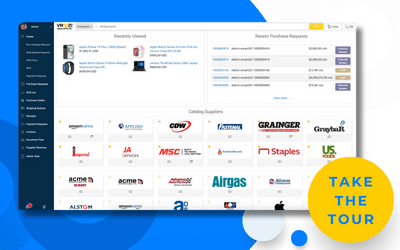

Are you ready to upgrade your tech stack to push your procurement and AP team into the future? Request a demo to see how Vroozi Intelligence can change the game.