Every business needs to buy products and services from other businesses. They must find suitable suppliers, select the best offerings, verify they have received what they ordered, and pay the supplier. That sounds straightforward, but as procurement scales, so does the complexity, the cost, and the opportunity for procurement fraud.

The procure-to-pay process is a set of steps for managing procurement in a transparent, predictable, and cost-effective way. It relies on recording each step of the procurement cycle with documents like purchase requisitions, purchase orders, and invoices, among others. It implements approval and budgeting systems for ordering and payments. And it depends on expert professionals like procurement and accounts payable specialists.

But, as rigorous as traditional procurement processes are, there is plenty of room for improvement. Manual document generation and data entry are better than opaque, ad-hoc buying, but they are labor-intensive, error-prone, and easily subverted. Procurement software solutions developed to address individual aspects of the procurement process tend to silo data, denying businesses a comprehensive view of purchasing and spending.

In this article, we walk through the procurement process and common challenges businesses face in achieving the procurement ROI they expect. Then, we explore how modern procure-to-pay software uses centralization, automation, intuitive user experiences, and artificial intelligence to overcome those challenges.

What Is the Procure-to-Pay Process?

The procure-to-pay (P2P) process, also known as purchase-to-pay, encompasses all business activities to acquire goods and services. It starts the moment a decision to make a purchase is made and extends until the invoice is paid in full.

Procurement is a multi-stage process that may involve stakeholders from several different departments, including the employees making the purchase, managers authorized to approve purchases, procurement teams, and the accounts payable teams.

Let’s explore the individual stages that make up a typical procurement process.

Identifying Suppliers and Products

First, an employee identifies the need for specific goods or services. Before they can buy anything, they must find a suitable supplier that delivers quality goods at competitive prices. The vendor selection process involves researching potential suppliers, comparing prices, and negotiating terms to ensure the business gets the best possible value for money.

Once suppliers have been found, an ongoing supplier relationship management program kicks in to maintain and enhance the relationship. It focuses on regular communication and performance monitoring to help the business to maintain a reliable supply chain.

Issuing Purchase Requisitions

When a supplier has been identified and goods or services selected, the employee creates a purchase requisition, a formal document that signals their intention to purchase. It includes information such as the buying employee’s details, item descriptions and quantities, estimated costs, the suggested supplier, and the reason for the request.

Requisition Approvals

Purchase requests are reviewed and approved by an authorized manager who will ensure the request is justified and within budgetary constraints. The approval process is essential to maintaining financial discipline, complying with procurement policies, and avoiding procurement fraud.

Purchase Order Creation and Approval

Once a purchase requisition is approved, a formal purchase order (PO) is generated and sent to the supplier. If the supplier acknowledges the PO and accepts the terms, it acts as a contractual agreement, detailing all pertinent aspects of the purchase like quantities, prices, and delivery specifics. The purchasing process may also require POs to go through an approval process before being sent to verify the details are accurate and in order.

Receipt of Goods

When the product or services are delivered, they are inspected against what was agreed upon in the purchase order. Verification ensures that what was delivered matches what was ordered. Any discrepancies are dealt with, and once the buying organization is satisfied, a confirmation of the goods or services received is created.

Invoice Receipt, Processing, and Approval

The supplier issues an invoice to request payment. The business’s accounts payable team verify the invoice is accurate by matching it against both the original purchase order and the goods receipt note to confirm consistency across all details.

If everything lines up and there are no discrepancies, the invoice is approved for payment. In addition to matching, there may also be a further approval process that requires the sign-off of an authorized manager.

Vendor Payment

Finally, the invoice is settled according to the agreed-on payment terms. Payment may involve cutting a check or, more commonly, initiating an electronic payment. Once the final payment is complete, one complete cycle of procure-to-pay processes is concluded.

Procure-to-Pay Challenges

Businesses invest in systems and staff to ensure the steps we’ve outlined run as smoothly and cost-effectively as possible. That’s why procurement and accounts payable departments exist. However, a reliance on manual processes and outdated digital systems prevent the procurement process from being as efficient, cost-effective, and error-free as possible.

Inadequate Spend Visibility

Manual, fragmented processes and systems hinder spend visibility and management. Businesses need to understand where their money is spent and on what. Without that insight, they can’t maximize value for money, optimize resource use, or effectively manage their budgets. Lack of spend visibility leads to wasteful spending, missed opportunities for cost savings, and ultimately, a weaker financial position.

High Procurement Processing Costs

High procurement processing costs arise from direct factors, such as paying more than necessary for goods and services, and indirect factors, like administrative expenses linked to inefficient processes. These inefficiencies lead to higher operational costs and decreased productivity.

Poor Quality Data

Manual data entry is prone to human errors, resulting in inaccurate records and inadequate analysis. The absence of real-time data impacts an organization’s ability to respond swiftly to changes, affecting overall operations and strategic decision-making.

Plus, manual data entry wastes employee time and resources in 2024. We have the technology to flawlessly extract data from procurement documents and free procurement and AP teams to focus on more strategic tasks.

Disconnected Procurement Systems

When procurement processes and data are scattered across different systems or departments without proper integration, it becomes difficult to get a comprehensive view of purchasing activities, spending patterns, and supplier performance. Fragmentation results in duplicated effort, an inability to make data-driven decisions, and missed opportunities for leveraging economies of scale.

Low User Adoption and Contract Compliance

Employees will often seek to bypass complex, unintuitive, and time-consuming procedures. When users within an organization are reluctant to engage with established procurement processes and systems, it can lead to rogue spending, making purchases outside of negotiated agreements. Rogue spending increases costs and exposes the company to potential risks and liabilities.

The Modern Procure-to-Pay Experience

We’ve seen how the procure-to-pay process works and some failure modes that increase cost, risk, and complexity. We built Vroozi to help businesses overcome these challenges.

Let’s explore what procure-to-pay experience looks like with our modern SpendTech® solution and some of what goes on under the hood to make that streamlined experience possible.

Shopping the Digital Marketplace and Purchase Requisition

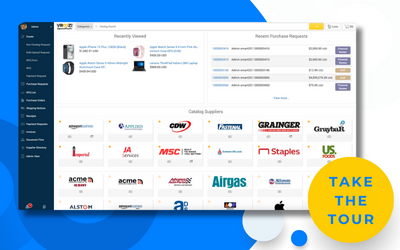

Imagine you’re an employee who wants to purchase office and cleaning supplies for their department. The first step is logging into the digital marketplace where you’ll find suppliers with pre-negotiated contracts.

You search for suitable products across all available supplier catalogs and access up-to-date pricing and rich product information, either within the marketplace or on the supplier’s e-commerce store, to which you are automatically redirected and authenticated.

You build a shopping cart, much as you would on a consumer eCommerce store. When you have finished selecting products, the order details are automatically returned to Vroozi or connected eProcurement and financial software. The system automatically generates a purchase requisition based on the cart.

How it works

The procurement marketplace is backed by a powerful catalog and supplier management system that integrates digital-ready suppliers via static hosted catalogs and eCommerce-based dynamic punch-out catalogs. The powerful search functionality allows users to search multiple catalogs simultaneously and compare items from different suppliers. When users check out, order data is collated into a purchase requisition for further internal processing.

eProcurement: Requisition Approval and Purchase Order Dispatch

After you submit the requisition, an automated approval workflow is triggered. The request is intelligently routed to your manager for review. They receive a notification, review the requisition details on their device, and approve the order, often with a single click.

The system then automatically converts the approved requisition into a purchase order and sends it to the supplier.

How it works

Vroozi’s eProcurement solution automates the purchase order process by managing the approval workflow efficiently, ensuring that only authorized purchases go through. Purchase orders are generated and transmitted to suppliers in their preferred format, including electronic PO formats like cXML, email, or via the supplier’s portal,

Goods Receipt

When the products arrive, you examine the delivery, comparing it to the purchase order. If the supplier delivered what you ordered in the correct quantities and a satisfactory condition, you create a goods receipt within the procure-to-pay platform.

How it works

Vroozi supports a seamless goods receipt process, quickly confirming deliveries against purchase orders (as well as non-PO orders). Users create full or partial goods and service receipts, making that information available to AP invoicing processes.

Invoice Capture and AP Automation

The supplier submits their invoice to request payment. By this point, the employee who placed the order has their products, and they need not be involved any further. Instead, the procure-to-pay system captures the invoice and carries out automatic three-way matching by comparing it to the purchase order and the goods or services receipt.

Once the match is confirmed, the invoice is routed for payment approval without manual intervention.

How it works

Vroozi’s accounts payable invoice automation transforms the entire invoice-to-pay process. AP invoice automation uses OCR and AI to reliably capture and carry out two- or three-way matching for invoices in any format.

If there are no discrepancies, the invoice can be automatically scheduled for payment or routed for approval, depending on the company’s AP policies. If there are discrepancies, the relevant employee is notified.

Invoice automation drastically reduces the time and effort required for invoice processing, ensuring accuracy and accelerating the payment cycle.

Payment

With the invoice approved, Vroozi Pay facilitates payment to the supplier using the company and the supplier’s preferred method, whether ACH, wire transfer, eCheck, or vCard. This process is secure and efficient, with comprehensive tracking and reporting features for oversight.

How it works

The payment module within Vroozi’s platform is designed to accommodate various payment methods, ensuring both flexibility and security in transactions. Vroozi Pay streamlines payment processing, workflow approval, and payment execution for over 140 currencies and 170 countries.

Vroozi’s payment process can be fully automated, enabling touchless straight-through processing according to custom tolerances and rules. If there are discrepancies or human insight is required, the system intelligently routes alerts to the right person.

Seamless Procurement with Enhanced Spend Visibility

Vroozi ensures comprehensive procurement data is available for spend analysis and reporting at every phase of the procure-to-pay process.

- The intuitive, user-friendly experience encourages internal buyers to adhere to the business’s procurement policies, reducing rogue spending and centralizing procurement data.

- Procurement automation eliminates manual data entry, improving accuracy while expediting the procurement cycle.

- Integration with third-party eProcurement, ERP, and financial software ensures procurement data is available to the software your business relies on.

To see Vroozi in action, experience a live version of the app or request a personalized walkthrough from one of our team members.