With a 65% probability of a recession occurring in the next 12 months, many companies are tightening their belts and preparing for tough times. Strategic financial management becomes non-negotiable during periods of inflation and uncertainty, and digital spend management solutions are helping businesses optimize their expenditure, ensure transparency, and make informed spending decisions.

As Grant Thornton, one of the world’s largest professional services companies, makes clear in its International Business Report, “Efficiency has become a priority and digital innovation is vital to achieving it. Companies must upgrade their systems and processes to develop leaner business models that can thrive at a time of slower growth.”

With the end of the calendar year approaching, now is a great time to button up your business expenses and take control of company spending. In this article, you’ll learn how to find the best spend management software solution for your business.

What Is Spend Management Software?

Business spend management processes aim to optimize the value and efficiency of a company’s spending and supplier relationships. Spend management covers a wide range of activities that include:

- Strategic sourcing: evaluating and choosing suppliers that offer the best quality and price for goods or services.

- Contract management: administering supplier contracts to ensure compliance, optimize financial and operational performance, and mitigate risks.

- Purchasing: placing, approving, and sending orders to approved suppliers.

- Invoicing: receiving, matching, and processing invoices.

- Payment: paying using appropriate means, including physical and virtual credit cards, bank transfers, or digital wallets.

Spend management software solutions help businesses automate and streamline these activities, making the entire spend management process more efficient and transparent. By integrating financial functions and data into a single platform, this software gives businesses a comprehensive view of their spending, enabling better decision-making and, ultimately, significant cost savings.

Spend Management vs. Expense Management

Spend and expense management software handle different aspects of a company’s spend: It focuses on optimizing and managing spend across a company, including procurement, supplier relationships, and contractual agreements. Spend management tools are often used by procurement teams and finance departments to manage and optimize the company’s external spending.

Expense management, in contrast, is primarily concerned with expense tracking and reimbursing employee spending. It streamlines submitting, approving, and reimbursing expense reports, ensuring that they comply with company policies. Expense management software is mainly used by employees, managers, and finance teams to manage expenses more efficiently.

Spend management systems may include expense management features, but they typically deal with a broader spending range.

Unlocking Financial Efficiency: The Role of Spend Management Software

Implementing spend management software is a strategic move for businesses aiming to optimize expenditure and enhance financial efficiency. Businesses often fail to fully control spending, particularly when spend data is siloed in mutually incompatible systems and processes.

Let’s look at some of the challenges businesses face as they work to rein in spending and how the right software can help.

Lack of Visibility

Many businesses struggle to gain a clear overview of all their spending sources, which can lead to overspending or unnecessary purchases. Spend management software helps businesses identify, categorize, and analyze cost centers and shadow cost centers, ensuring that every dollar is accounted for.

Poor Data Accuracy and Quality

Inconsistent, incomplete, or erroneous data entry is a common issue, especially for businesses relying on manual processes or dealing with diverse data formats. Inaccuracies can lead to misguided purchasing decisions and increased costs.

Spend management software addresses this challenge by collecting, validating, and standardizing data from multiple sources, ensuring data accuracy and quality, and paving the way for more reliable financial decisions.

Limited Control Over Purchasing Activities

Without adequate policies and procedures, businesses find it challenging to regulate purchasing activities, leading to unauthorized spending, fraud, or maverick buying. They need robust tools to implement and enforce controls on purchasing activities, ensuring compliance with company guidelines, preventing wasteful spending, and reducing financial risks.

Challenging Supplier Relationships

Robust and collaborative supplier relationships are crucial for maintaining quality standards and timely deliveries. Spend management enhances collaboration and communication within the supply chain, improving the quality and effectiveness of supplier interactions.

In summary, a spend management platform helps businesses overcome these challenges and more by providing much-needed visibility and oversight. For example, a solution like our digital marketplace can direct individual purchasers toward pre-approved vendors offering contract pricing. At a higher level, our SpendTech procurement platform provides 100% visibility into company spend to facilitate productive decision-making.

Choosing the Best Spend Management Solution for Your Business

In each scenario described above, there’s a clear use case for software. But, because each company’s requirements will vary, it can be helpful to identify spend management solutions by features, not by name.

With that in mind, the following are some of the key features you may want to look for when choosing a good spend management software solution for your business:

- Streamlined purchasing: Your software should make it easy to generate and transmit purchase orders and accurately match and reconcile invoices. The best tools, like Vroozi, integrate automation technology to reduce manual effort in carrying out these and other tasks.

- Contract management facilitation: As supplier contracts are negotiated and approved, you must have a single source of truth for stakeholders who need to access or review finalized contracts.

- Centralization of approved vendors: The platform should drive buyers to pre-approved vendors to avoid rogue spending and tail spending. Controlling where and when purchases can be made through a central supplier portal ensures that buyers can take advantage of pre-negotiated pricing discounts.

- Cost forecasting: The best spend management software includes built-in analytics capabilities that allow you to monitor current spending and forecast future costs. This level of visibility may also help your procurement team identify opportunities for spending optimization, thereby contributing to lower costs in the future.

- Integration capabilities: It’s vital that any solution you choose seamlessly integrates with other systems and software used by your business, such as ERP systems, accounting software, and procurement tools.

- Automated workflows and approvals: Solutions that automate workflows and approval processes are preferable, as automation reduces manual effort, minimizes errors, and accelerates time-consuming processes.

- Mobile accessibility: Mobile accessibility ensures that team members can access the necessary information and perform tasks such as requisition approvals on the go, which enhances flexibility and responsiveness.

- Virtual and physical cards: Integrated management of virtual and physical payment cards allows for versatile payment options, enhanced security for online transactions, and simplified expense tracking.

The Best Spend Management Solutions

Depending on your company’s existing tech stack, you may already have some of the capabilities described above. Familiarize yourself with your existing technology — as well as your budget and integration requirements — before evaluating the top spend management software available today.

Ramp

Ramp bills itself as a modern finance platform, but its true focus is its corporate card offerings. Unlike other solutions, Ramp offers:

- Unlimited physical and virtual cards

- A consistent 1.5% cash back on all card purchases

- Simplified employee card management

- No personal credit checks or guarantees

- Streamlined expense management and employee reimbursements

- A free version with limited features

In addition, Ramp offers a broader financial operations suite that includes procurement, accounts payable, and vendor management functions to support card transactions and other expenses. However, customers who plan to use Ramp cards in their day-to-day spending will likely get the most utility out of the software; those who need a greater degree of AP automation or more robust expense and billing tools should consider a different provider.

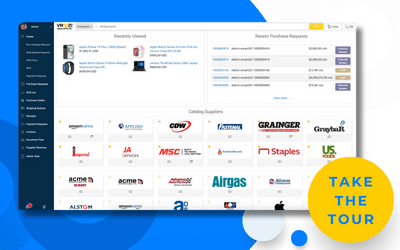

Vroozi

Unlike Ramp, Vroozi offers full procure-to-pay (P2P) support, including:

- Accounts payable automation through cognitive OCR, machine learning (ML), and other advanced technology to streamline invoice processing for your company, enabling you to run a leaner team.

- A digital payments portal that makes paying your suppliers simple and secure.

- eProcurement features that optimize purchasing across departments by automating purchase order generation and approval, driving buyers to a central supplier portal of approved vendors, and providing 100% visibility into all spending.

- A customizable digital marketplace that offers employees an ecommerce-like shopping experience while making sure that spending is compliant with contracted vendors and aligned with CSR goals.

That said, it’s worth noting that Vroozi is best suited to support enterprise-level organizations. Smaller companies may be better served by solutions that offer entry-level tiers, such as Airbase.

Airbase

Like Ramp, Airbase offers corporate cards and the technology to seamlessly manage their charges. One place the two differ, however, is in the degree of automation present within their platforms. Airbase, for instance, includes:

- Guided procurement features that provide visibility into stakeholder progress

- OCR and auto-matching for invoices and receipts

- Auto-payment upon bill approvals

- The ability to skip approvals for bills that match existing invoices

- Advanced reimbursement workflows

Unlike Ramp, Airbase does not offer a free tier (though accessing Ramp’s more advanced features and security protocols requires a paid subscription). Smaller companies seeking a more affordable entry point may want to consider BILL.

BILL

Though both BILL and Ramp lack the finance and purchasing capabilities of Vroozi (and, to a lesser extent, Airbase), the two solutions offer comparable corporate card access and management, thanks to BILL’s acquisition of Divvy in 2021. A few key advantages of BILL include:

- A lower minimum bank balance compared to Ramp

- Accessible to sole proprietorships

- Mobile app and phone-based support

- Up to 7X points on purchases

- Automated workflow features available with paid plans

Transforming Spend Management: A Five-Step Journey

Navigating the complexities of spend management requires a strategic approach, ensuring that every dollar spent contributes positively to your business’s growth and efficiency. Software plays a vital role in a strategic approach to transforming how your company handles spending.

Step 1: Elevate Supplier Relationships

Suppliers are more than just transactional partners; they are pivotal to your business’s success. Conduct comprehensive supplier evaluations to make sure you have the best suppliers with the most beneficial contracts. Embrace a culture of continuous feedback and performance reviews to create a collaborative environment that fosters quality and efficiency.

Step 2: Unify Your Spend Management Ecosystem

To manage spending effectively, you need a bird’s-eye view of your entire spend landscape, with every transaction and approval seamlessly flowing through a centralized system. This is what unifying your processes gets you. It’s all about breaking down silos, standardizing procedures, and empowering your team with real-time insights to make informed decisions.

Step 3: Craft and Enforce Financial Boundaries

Financial discipline is the cornerstone of effective spend management. Craft clear, comprehensive spending policies and make sure they are not just documents gathering dust. Transform them into living guidelines, actively upheld and woven into the fabric of your company’s culture and processes, with regular training and audits to keep everyone on the right track.

Step 4: Build a Financially Savvy Culture

Financial responsibility should not just be the responsibility of your finance team; it should be woven throughout your entire organization. Foster a culture where every employee is a custodian of the company’s financial well-being, understanding the ripple effects of their spending decisions and proactively contributing to cost-saving initiatives.

Step 5: Continuous Financial Vigilance

Effective spend management is not a one-time project. It’s an ongoing process that requires continually monitoring and analyzing spending patterns, and being ready to pivot and refine your strategies based on real-time data and employee feedback.

Embrace the Future with Spend Management Software

As you navigate these transformative steps, adopting a spend management solution can be your compass and catalyst, streamlining processes, automating routine tasks, and providing actionable insights. Effective businesses leverage technology to enhance control, drive efficiency, and support the best decisions in an uncertain economic landscape.

Why Vroozi for Business Spend Management?

Ultimately, the right spend management software solution for your company will come down to your individual needs, the size of your organization, and the sophistication of your operations. If you’re looking for an easy-to-use platform that can support your end-to-end procure-to-pay (P2P) cycle with advanced features and functionalities, Vroozi is worth a look.

To see Vroozi in action, play around in a live version of the app or request a personalized walkthrough from one of our team members. We would love to be the greatest success story in your digital transformation journey!