Many mid-market businesses fail to see spend management for what it truly is: a competitive weapon for driving growth, profitability and financial control.

Today’s procurement and accounts payable processes create a wealth of data. That data can be captured, analyzed and used to improve financial outcomes. Or it can sit in disparate systems and filing cabinets across the organization, and offer little to no financial and procurement value.

The Key to Spend Under Management and Financial Visibility

Spend analytics technology helps solve two of procurement’s biggest headaches: low spend under management and a lack of financial visibility.

For small and mid-sized businesses that don’t talk procurement lingo, spend under management is simply the amount of your organization’s spend that is actively managed. In other words: are you being intentional about who you are spending with, how much, when and why? And are you tracking and analyzing it? Spend management is important for businesses of every size and shape – not only enterprises.

If your answer to either question is no, you are likely spending more than you need, and exposing your organization to risk by purchasing through unapproved third parties. Typically, low spend under management is also a tell-tail sign that employee adoption is poor and rogue purchasing is high. This creates similar problems, while also draining operational efficiency and eliminating financial visibility.

Enter spend analytics.

Effective business spend management increases financial visibility and enables organizations to identify which spend categories are being managed – or not. Today’s tech also pinpoints the root of the problem, so you can eliminate it all together. The best part is that everything is automated. Spend analytics adds the most value when it sits at the center of the procure-to-pay process, and automatically and continuously extracts and digitizes key spending data from budgets, purchase orders, invoices, goods receipts, payments and more. The more visibility you have into business spend, the more you can identify opportunities to save, reallocate spend, invest, and increase control.

Data Confidence and Intelligent Financial Decisions

Gartner reports that the cost of poor decision making affects annual profit by at least 3%.

In other words: Big financial decisions should be driven by hard data, not a gut feel. But you have to trust your data. Digitization plays a key role.

Many procurement and AP teams still operate in silos and manage purchasing, vendor invoices and payment processes manually. This impacts data quality. The data is harder to track, more likely to be outdated or incomplete, and prone to errors.

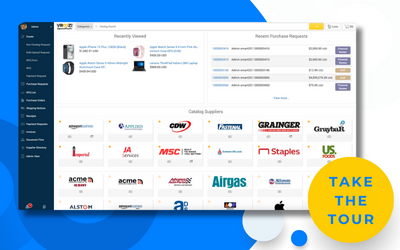

The integration of a modern and digital P2P solution with robust spend capabilities eliminates this challenge by automating the entire process and providing a multifaceted view of purchase orders, accounts payable, payments, invoices, spend, categories, suppliers, budgets and more. By automating the collection, cleansing and normalizing of spend data, and centralizing it digitally, you create a single version of the truth that can be trusted and relied upon to make decisions and analyze past performance.

The right spend analytics platform also allows for optimization of key spend by category, budget, region and supplier. The depth of this analysis will undoubtedly help you uncover opportunities to strengthen the financial health of your organization.

Analyzing past and real-time spending patterns helps you project future trends and gain insight into what’s working and what’s not. For example, maybe you are buying similar supplies from three different vendors. Could that spend be consolidated with one party at a lower cost? Or maybe you negotiated a terrific rate with one supplier, but your employees are buying rogue from another party, outside your marketplace, and therefore you are losing out on negotiated savings. The right platform will also provide access to key performance indicators, like the percent of purchase orders vs. non purchase orders, and help you improve performance over time.

These are three small examples of where and how spend analytics improves the bottom line and increase financial control for mid-market companies.

If you haven’t yet embarked on your analytics journey, there is no better time to begin than now. Spend analysis helps cut costs, improves efficiency and increase financial control. Who wants to wait for those outcomes?

When coupled with a best-of-breed digital procurement platform, spend analytics gives companies an invaluable competitive advantage – the ability to adapt, evolve and make smart, data-based financial decisions that elevate performance.

To learn more about this topic, download our latest report: The Road to Financial Resillance: 4 Ways to Control Costs in 2021.