And your concerns are warranted! Any holdups in three-way or two-way matching processes can directly impact your organization’s bottom line and wreck your day.

However, not all procurement leaders understand how deep holdups in purchase order (PO) and invoice processes cut into the organization’s growth strategy. Here’s everything you need to know about three-way matching, including ways to increase straight-through processing with automation.

What Happens When Three-Way Matching Goes Right?

The three-way matching process includes lining up three documents at each step of the procure-to-pay (P2P) process:

- Purchase order

- Goods receipt or confirmation

- Supplier invoice

If all three match, the invoice is approved, finance receives the OK to pay, and all parties are happy. However, if one of the three is off, teams must stop what they’re doing, which can lead to problems. It can also be difficult to track down and organize goods receipts manually.

What Happens When Three-Way Matching Goes Wrong?

Often, three-way matching doesn’t go as smoothly as planned. Everything from missing information to handwritten invoices to simple mistakes can cause mismatches. Here are some of the consequences that can occur when straight-through processing is disrupted:

- Late payments: Every time someone at your organization has to track down problems, input data, or fix errors, it slows down payments. That can hurt supplier relationships and make it harder for them to perform effectively.

- Extra work: If procurement and accounts payable have to work on identifying, fixing, or adjusting inaccurate data caused by errors, it pulls time out of their days, distracting from more strategic work.

- Additional costs: Extra human touches increase errors and the cost per PO and invoice.

- Clouded spend visibility: Manual processes and errors can leave procurement with inaccurate and limited spend visibility.

- Longer cycle times: Inefficient processes can hold up orders and cause longer cycle times.

Two-Way Matching Is Also at Risk

Some organizations will use two-way matching, where the goal is to match the supplier invoice and purchase order. However, this process can be riddled with the same costly errors as three-way matching. It can also beg the question: “Did we get the products we ordered or were services performed?” A handwritten invoice, typing mistake, or missed detail can throw off straight-through processing.

When companies run this process manually, it can also leave them susceptible to fraud and inaccuracies during invoicing.

How to Automate Two- and Three-Way Matching

The easiest way to improve two- and three-way matching and increase straight-through processing is to adopt an automated P2P solution. Here’s how this technology boosts P2P process efficiency:

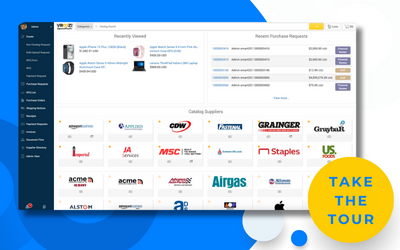

- Digitized processes: Advanced platforms make it easy to digitize your entire P2P process. These platforms include a digital marketplace where employees can quickly find suppliers and purchase items. That means more suppliers are digitally enabled, more of the PO process flows through your system, and your team can push approved and compliant invoices straight through.

- AI and machine learning: Top-tier P2P platforms include cognitive optical character recognition (OCR), which will scan PDF or paper invoices and automatically transfer information into your digital system. That means less human input, faster payments, fewer errors, and clearer spend data.

- Built-in two-way and three-way matching: Advanced platforms include built-in matching down to the line items. The platform automatically identifies duplicates, overpayments, and other errors, so teams are freed up to complete more strategic work.

How Automating Three-Way Matching Improves the Organization

By streamlining invoice and PO management, automated P2P solutions empower procurement leaders and strengthen your entire operation. Here are a few ways increasing two- and three-way matching with a P2P solution can benefit your organization:

- Lower costs and fewer errors: Automated P2P solutions eliminate the errors that come from human input, identify mistakes humans may miss, and save your company time and money.

- Supply chain resilience: By sharpening the P2P process, you can improve cycle times and build supply chain resilience. That can protect against supply chain disruptions and boost your organization’s bottom line.

- Stronger supplier relationships: In addition to improving relationships by speeding up payments, automated P2P solutions also shave down the amount of work procurement has to spend on tasks. The result is more time to focus on sourcing, negotiating, and building relationships.

- Clearer spend visibility: With digital P2P solutions, spend data will flow smoothly through your enterprise resource planning (ERP) or digital payment system. These solutions leave you with clear spend data, allowing you to make smarter strategic decisions.

Start Building Your Case for P2P Automation

Are you ready to be rid of those long nightmares about three-way matching and botched P2P processes? P2P automation can reshape work and redefine what your procurement team can accomplish.

First, you’ll need to make a business case for P2P automation and build support for new technology. Download How to Make a Business Case for Procure-to-Pay Automation to learn how to take the next steps toward automation.