According to the Association of Certified Fraud Examiners, fraud can cost businesses up to 5 percent of their revenue each year. Although this may seem insignificant, it equals a median loss of around $125,000 annually. Even more alarming? Fraud goes undetected for an average of 14 months, leading to financial losses of about $8,300 per month.

Fraud in the accounts payable (AP) process includes check tampering, false expense reimbursement, and billing schemes like overcharges from suppliers or false payment solicitation. Fraud can be committed by internal (employees) or external (cybercriminals, third parties) groups or individuals.

The 2022 AFP® Payments Fraud and Control Survey found that 71 percent of organizations experienced payment fraud attacks or attempts in 2021. Checks and ACH debits were the payment methods most affected by fraud, with 66 percent of checks and 37 percent of automated clearing house (ACH) debits negatively impacted by fraudulent transactions.

Sixty-eight percent of organizations were targeted by business email compromise last year. Accounts payable departments were the most likely to experience this type of scam, with 58 percent of survey participants admitting their AP department was targeted by fraudulent emails.

What does fraud look like in the accounts payable process?

There are many different types of AP fraud that can negatively impact businesses and the customers they serve. Let’s take a look at some of the most common scams:

Shell Companies

One of the most common types of fraud, shell companies are fake businesses set up to receive payments anonymously. It can be difficult to track payments made to a shell company, and this type of scam involves an employee creating a false invoice to pay for fictitious products or services. Once the invoice is created, the employee writes a check to the shell company, taking cash from the victim’s business.

A similar scam is known as the “pass-through” scheme. This occurs when an employee who approves invoices and payments uses a shell business to order items from another supplier. Then, the items are marked up and sold to the victim’s business under the guise of the shell company.

Check Fraud

Check fraud involves employees forging or stealing checks and depositing them into their own accounts. An intelligent procure-to-pay platform that streamlines business transactions (like Vroozi) can reduce the number of checks going through so that check fraud can be detected more easily. Vroozi will also verify that all check payments are legitimate. When approved payments go through a controlled process, it ensures that the spend is legitimate.

ACH Fraud

This can occur when fraudulent invoices are created that appear to be from suppliers. However, when someone in AP clicks on a link to enter their company’s account information and make a payment, they’re redirected to a fraudulent payment site. Once cybercriminals have access to this valuable data, they can transfer funds into their own account.

ACH fraud can also occur when an employee opens a personal debit or card account using an employer’s account data.

How can you prevent fraud in the accounts payable process?

- Conduct background checks on all employees before hiring. Avoid hiring individuals with past criminal offenses.

- Establish procedures that encourage whistleblowers to speak up if they witness fraudulent activity in the accounts payable process.

- Develop a tip line for employees to report fraud and have standard processes for when they do come forward.

- Develop clear policies for expense reimbursement.

- Establish a written code of ethical behavior for employees.

- Be proactive with an intelligent procure-to-pay platform like Vroozi, which can enforce control and segregation of duties, conduct regular audits, and look out for duplicate payments.

- Check vendor master files to spot invoices from false suppliers. A platform like Vroozi will also ensure that all vendors are pre-approved.

- Clearly define roles in the accounts payable department. Separate bookkeeping and check-signing duties to boost individual accountability.

- Utilize a platform like Vroozi to verify the integrity of invoice data and supplier information.

- Verify and update the vendor master file regularly, using a platform like Vroozi to ensure vendor data is current.

How can Vroozi reduce fraud in AP departments?

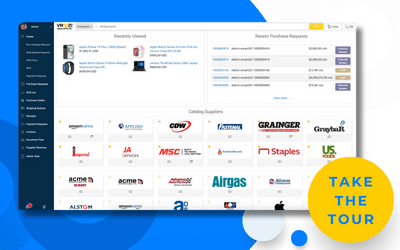

Vroozi automates processes to save time, reduce workloads, and improve outputs. It also helps eliminate tedious tasks, allowing staff to focus on strategic initiatives like analyzing invoice data, preventing fraud, and managing budgets.

Vroozi’s spend management technology also can track all transactions, offering more visibility into spend and identifying any red flags. Meanwhile, three-way checks between purchase orders, goods receipts, and invoices help identify fraud before it happens, and supplier master data checks ensure that invoices are related to legitimate suppliers.