PwC’s latest Global Economic Crime and Fraud survey uncovered 56% of respondents experienced fraud in the last two years – the greatest number ever recorded. The increase in procurement fraud is especially concerning, accounting for a fifth of all reported fraud incidents.

Companies have the potential to lose thousands or millions of dollars annually to invoice and procurement fraud. More often than not, that loss goes unnoticed, slowly draining from the bottom line until it’s too late.

Consider the financial implications. A 2020 report from Association of Certified Fraud Examiners (ACFE) says that organizations lose 5% of revenue on average to fraud. For a growing, $100M company, that’s 5 million dollars. The losses can be much more substantial for enterprises.

Today, the risk of fraudulent invoices slipping through the cracks is greater than ever. The three most common types to watch for are fake vendors, fake invoices and inaccurate or over-billed invoices.

Technology advancements have made spotting invoice and accounts payable fraud much easier today than it was years ago – but organizations still need to invest and act.

Enter AI-based Accounts Payable Invoice Automation

AI-based accounts payable invoice automation (APIA) enables procurement and finance teams to elevate AP operations and protect against fraud. The technology doesn’t simply automate, it’s smart, intelligent and capable of learning over time.

Rather than manually spot checking transactions – which takes time, resources, and opens up the organization to additional exposure – modern organizations are turning to APIA to automatically watch and audit transactions in real time.

With automated three-way match, you can easily check invoices against purchase orders (POs) and goods receipts so you know you are paying against pre-approved funds, agreed upon terms, and goods and services actually received, and never pay on a fraudulent charge.

“There is a clear link between fraud prevention investments made upfront and reduced cost when fraud strikes.”

Invoice verification is especially important when it comes to the 50% of invoices on average that get processed without an accompanying PO. It’s much more difficult to catch instances of fraud when there’s no PO and you don’t have anything to match against. In these cases, you must chase down people who can verify the expense or rely on trend analysis to detect fraud – a nearly impossible task without intelligent technology.

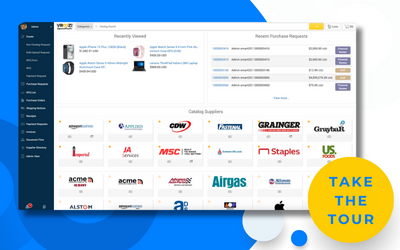

For example, Vroozi’s AI engine automatically analyzes key spend and performance data, such as historical trends and payment patterns, and provides data-based insights that can spot fraud as well as improve the speed and accuracy of decisions. The tech can automatically and accurately scan invoices, structure the data to be used for processing and analysis, codes the invoice for accurate accounting, ensures the right person reviews and approves, and learns from historical data to uncover overbillings and payment errors. This data can also be leveraged in the supplier performance analysis by helping to identify vendors that are wildly overcharging for the goods and services they provide, compared to historical data on similar purchases.

With APIA and connected payment processes, you can also ensure that you only pay pre-approved suppliers that are included in your vendor master records rather than fraudsters impersonating your vendors.

An added bonus of APIA: AP and finance teams no longer need to worry about keeping track of country-specific e-invoicing and tax compliance laws that are constantly changing. Instead, companies can rely on the tech to capture the data in multiple languages and formats, and to follow the rules that keep companies away from penalties and out of the news.

While fraud can never be completely eliminated, manual payment processes increase exposure. Digitization and AI can help identify instances of fraud automatically, before it impacts your bottom line and your brand reputation. The key is making the investment in the right technology that will set you up for success.

Learn about the other benefits of AI and Accounts Payable Invoice Automation by checking out our two-part blog series: