If you’re a chief financial officer (CFO) or another financial leader, you may be anxiously watching cash sources dry up around you. Unfortunately, the cash drought could worsen. As costs remain high, interest rate hikes make borrowing expensive, and a recession threatens new business, you need to untap cash flow any way you can.

Fortunately, improving one key area of the business can burst cash flow wide open: the procure-to-pay (P2P) process.

With the right P2P solution, you can cut waste in this critical area of your business, increase productivity, and free up more funds. This is how procure-to-pay solutions work and four ways you can use this technology to maximize cash flow.

What Is Procure-to-Pay?

P2P refers to the processes that connect procurement to accounts payable (AP). That includes sourcing, purchasing, spend management, invoicing, payments, reporting, and everything in between. P2P solutions use technology to digitize, automate, and streamline your business’ procure-to-pay processes. On a high level, these solutions tie together processes, trim down waste, and increase productivity across the entire P2P chain.

Are you wondering how automated P2P solutions work?

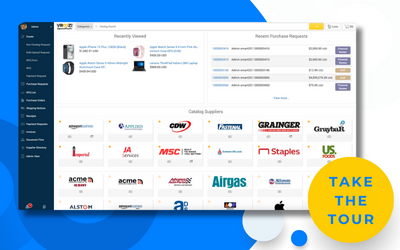

Advanced P2P solutions make it easy for employees to identify and purchase goods and services with approved suppliers through a centralized digital marketplace. In addition to gathering, sharing, and organizing information across the entire P2P pipeline, these solutions also cut down work for employees throughout procurement and AP. For instance, they let employees track shipments, manage approvals, automatically complete 2- or 3-way matching, automate workflows, and analyze reports—all on a single platform in a matter of clicks.

How Procure-to-Pay Can Maximize Cash Flow

Here are a few ways procure-to-pay solutions can open up more cash flow for the organization:

1. Increase on-time payments.

Advanced P2P solutions use automation to cut out time-consuming tasks from an employee’s schedule. For instance, top-tier platforms automate 2- and 3-way matching and drive more straight-through, no-touch invoice and PO processes. Platforms that include cognitive ocular character recognition can also scan paper or pdf invoices and transfer information into your ERP or digital payment system. That eliminates work for employees, reduces errors, and speeds up the payment process.

By using technology to speed up the payment process, you can open up new opportunities to negotiate discounts. It also unearths early payment discounts. The result is more cash and more resources to improve the business.

2. Improve inventory levels.

P2P solutions can increase your inventory visibility. As a result ,you can decrease lead times, which means your company can cut down the amount of inventory you need to keep on hand. Ultimately, P2P solutions shine light on more accurate inventory insights, which leaders can use to sharpen cycle times, improve inventory levels, and build supply chain resilience—a recipe to maximize cash flow. In turn, by reducing inventory levels and seeing clear inventory data, you can build a lean operation that’s prepared to adjust quickly when supply chain disruptions arise.

3. Reduce the high costs of inefficient processes.

By cleaning up P2P processes, these automated platforms decrease the cost to process invoices and payments. In addition to automating the purchase order (PO) and invoice management process, machine learning can identify patterns and improve workflows. By tightening processes and reducing errors, P2P solutions save the operation money and maximize cash.

4. Improve budgeting.

P2P solutions can improve budgeting several ways. For one, they reduce human touches throughout the P2P process, cutting down errors and leading to more accurate financial reports. Platforms also gather PO, invoicing, purchasing, and other important information and stream it within a single system. As a result, financial leaders will have clear reports they can use to budget and see more opportunities to free up extra cash. That also means, with clear, accurate financial data in hand, you can avoid surprises, predict costs, and keep spend under budget.

Start Building a Business Case for P2P

By using P2P solutions to build a more efficient procure-to-pay pipeline, CFOs can unlock cash at a critical time for their businesses. These platforms boost efficiency, lower costs, free up labor to make more strategic decisions, and lay out spend data that can spotlight new opportunities.

Need to secure buy-in from your fellow leaders before you adopt a P2P solution? Download our free guide, “How to Make a Business Case for Procure-to-Pay Automation,” to learn how to get your team onboard.